Emissions Trading Market Is Estimated To Witness High Growth Owing To Increasing Adoption of Carbon Emission Reduction Policies

The global emissions trading market is estimated to be valued at US$334.80

billion in 2023 and is expected to exhibit a CAGR of 24% over the forecast

period 2023-2030, as highlighted in a new report published by Coherent Market

Insights.

Market Overview:

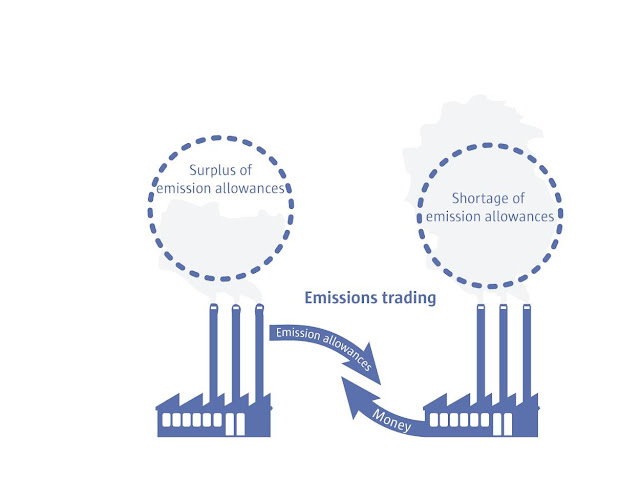

The emissions trading market refers to the buying and selling of emissions

permits or credits, which represent the right to emit a certain amount of

greenhouse gases. This market allows companies to meet their emissions

reduction targets by either reducing their own emissions or purchasing credits

from other companies that have emitted less. The advantages of implementing

emissions trading include cost-effectiveness, flexibility, and the ability to

incentivize innovation in emission reduction technologies. With the increasing

concerns over climate change and the need to reduce greenhouse gas emissions,

the emissions trading market is expected to grow significantly in the coming

years.

Market Key Trends:

One key trend in the emissions trading market is the growing adoption of carbon

emission reduction policies by governments and organizations worldwide.

Governments are implementing regulations and schemes such as cap-and-trade

systems to limit and reduce the total emissions of greenhouse gases.

Additionally, companies are voluntarily participating in emissions trading to

demonstrate their commitment to sustainability and environmental

responsibility. This trend is driven by the increasing awareness of climate

change and the need to mitigate its effects. As a result, the demand for

emissions permits and credits is expected to increase, driving the growth of

the emissions trading market in the forecast period.

PEST Analysis:

Political: The political factors impacting the emissions trading market involve

government policies and regulations. Governments across the globe are

implementing stricter regulations to curb greenhouse gas emissions, which is

driving the growth of emissions trading. For instance, the Paris Agreement

signed by several countries aims to limit global warming, encouraging the

adoption of emissions trading.

Economic: Economic factors affecting the emissions trading market include the

cost of carbon credits and market incentives. The increasing demand for carbon

credits and the introduction of market-based mechanisms are driving the growth

of this market. Additionally, the potential for financial gains through

emissions trading is attracting both companies and investors.

Social: Social factors influencing the emissions trading market include public

awareness and acceptance of climate change issues. With increasing awareness

about the environmental impact of greenhouse gas emissions, individuals and

organizations are more inclined to support and engage in emissions trading,

contributing to market growth.

Technological: Technological advancements play a crucial role in the emissions

trading market. Development in carbon capture and storage technologies, as well

as the use of artificial intelligence and blockchain solutions, are improving

the efficiency and transparency of emissions trading. These technological

advancements are expected to further accelerate the growth of the market.

Key Takeaways:

The global

emissions trading market is projected to witness high growth,

exhibiting a CAGR of 24% over the forecast period (2023-2030). This growth can

be attributed to increasing government regulations and policies aimed at

reducing greenhouse gas emissions. The market size for 2023 is estimated to be

US$ 334.80 billion.

In terms of regional analysis, Asia Pacific is expected to be the

fastest-growing and dominating region in the emissions trading market.

Increasing industrialization, urbanization, and the adoption of renewable

energy sources in countries like China, India, and Japan are driving the demand

for emissions trading in the region.

Key players operating in the emissions trading market include BP Plc, Royal

Dutch Shell Plc, Total SE, Chevron Corporation, ExxonMobil Corporation, Engie

SA, RWE AG, ON SE, Vattenfall AB, Gazprom, Mitsubishi UFJ Financial Group

(MUFG), JPMorgan Chase & Co., Goldman Sachs Group, Inc., Citigroup Inc.,

and Barclays PLC. These key players are actively involved in emissions trading

and are expected to contribute significantly to market growth.

Comments

Post a Comment